Singapore is often viewed as the most straightforward market to enter in Southeast Asia. Its strong rule of law, efficient infrastructure, high digital adoption, and strategic location make it an attractive gateway to the region. However, market entry data and industry case studies consistently show that success in Singapore is not automatic.

Companies that succeed approach expansion through a data-led Singapore market entry strategy, while those that treat the market as a simple extension of their home geography frequently underperform or exit early. The difference lies in preparation, localization, and execution grounded in local evidence rather than assumptions.

Why Singapore Is an Attractive Market — What the Data Shows

Strong regulatory and operational environment

Singapore consistently ranks among the world’s most efficient business environments. Clear regulations, predictable enforcement, and transparent compliance processes reduce uncertainty for businesses that prepare properly. While compliance standards are strict, they are well-defined, making Singapore easier to operate in compared to many regional peers once requirements are met.

Digitally mature consumers and enterprises

Singapore has one of the most advanced digital economies in Asia. Businesses and consumers alike expect seamless digital experiences, from discovery and payments to delivery and after-sales service. High digital adoption influences everything from go-to-market strategy to pricing, customer engagement, and fulfillment models.

High purchasing power and urban consumption patterns

Singapore’s urban, high-income population supports strong demand for premium, convenience-driven, and technology-enabled products and services. For many companies, the market serves as an effective testbed for premium offerings before regional expansion.

What the Data Reveals About Why Companies Succeed in Singapore

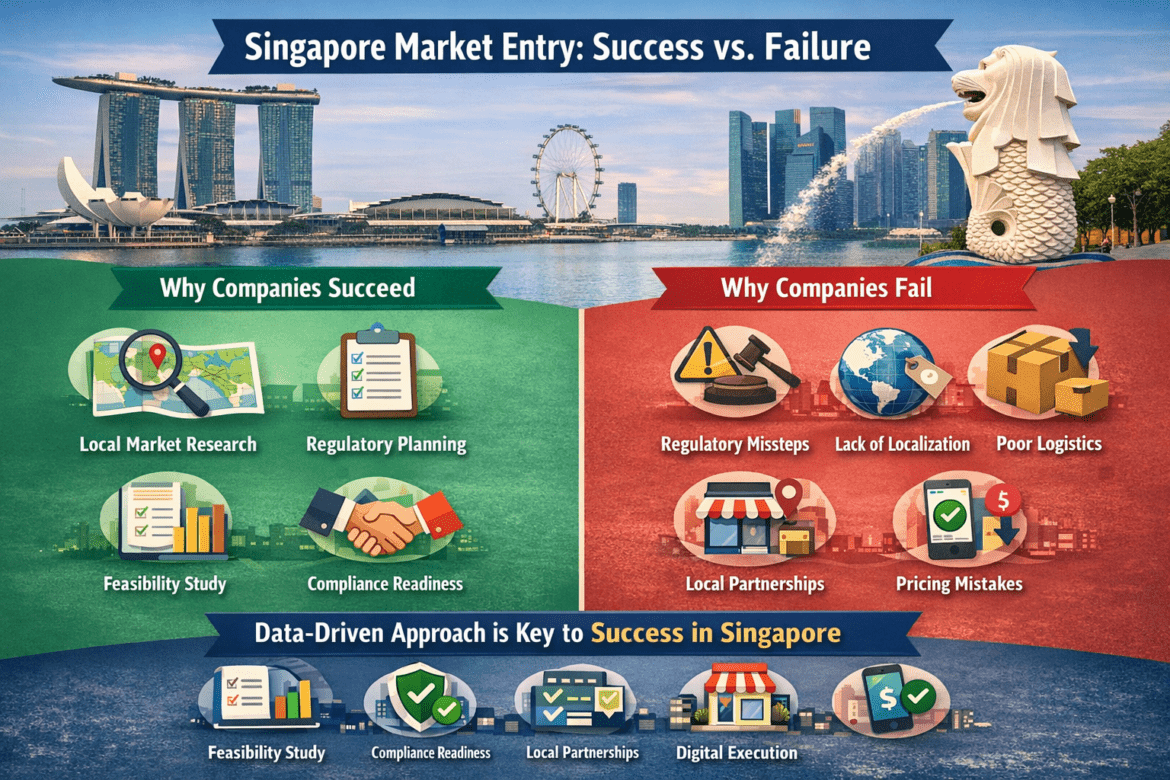

Across successful market entry cases, several consistent success factors emerge:

1. Deep local market research and segmentation

Winning companies invest in Singapore-specific consumer and B2B insights, rather than relying on regional or global averages. Understanding local price sensitivity, channel preferences, decision-making drivers, and competitive dynamics enables faster product-market fit and stronger early traction.

2. Early regulatory and compliance planning

Singapore’s efficiency does not eliminate regulatory complexity. Successful entrants conduct early reviews of licensing, product standards, tax obligations, and data protection requirements. Addressing compliance upfront shortens approval timelines, reduces launch delays, and prevents costly post-entry corrections.

3. Strong local partnerships and distribution strategy

Effective market entrants leverage local distributors, logistics providers, retail partners, and marketing agencies that understand Singapore’s ecosystem. These partnerships accelerate time-to-market and help companies navigate channel nuances that are difficult to manage remotely.

4. Digital-first execution

High digital penetration means that digital capability is not optional. Companies that prioritize fast checkout, local payment methods, efficient delivery, and personalized digital communication consistently outperform those relying on offline-first or legacy models.

Why Companies Fail — Common Data-Backed Mistakes

Market entry failures in Singapore tend to follow a predictable pattern:

1. Underestimating regulatory requirements and timelines

Missing a licensing step, misunderstanding product standards, or misjudging approval timelines can delay launches and inflate costs. Even in an efficient environment, lack of regulatory planning remains a leading cause of failure.

2. Treating Singapore as “just another market”

Companies that transfer home-market pricing, messaging, or product assortments without localization often struggle. Singapore consumers have high expectations for quality, service, and digital convenience and are quick to disengage from brands that miss the mark.

3. Weak channel and logistics planning

Poor distributor selection, underinvestment in last-mile delivery, or unclear returns and customer support policies can quickly damage brand perception. Logistics performance and service reliability play an outsized role in customer retention.

4. Ignoring pricing elasticity and cost structure

Singapore’s high operating costs and premium positioning in many categories make pricing strategy critical. Companies that fail to test price sensitivity or model margins accurately often face profitability challenges even when demand exists.

A Practical, Data-Led Checklist Before Entering Singapore

Before launching, companies should validate the following:

-

Conduct a Singapore market feasibility study covering demand size, competitive landscape, channel economics, and cost structures using local benchmarks

- Map all regulatory and compliance requirements early, including licensing, product standards, tax registration, and data protection obligations.

- Pilot pricing and positioning through controlled launches, marketplace tests, or limited-scale rollouts to capture real conversion data.

- Secure experienced local partners across distribution, logistics, and marketing, with clear performance metrics and accountability.

- Design a digital-first customer journey with local payment options, fast fulfillment, transparent returns, and responsive support.

- Allocate budget for localization, including packaging, labeling, customer service, and tailored marketing communication.

What Successful Market Entry Typically Looks Like

Pilot-led entry with parallel compliance planning

Companies that test the market through pilots or limited launches while progressing regulatory approvals tend to minimize risk and accelerate learning.

Digitally enabled, experience-driven models

Brands that combine localized digital commerce with strong customer experience both online and offline, often achieve higher conversion rates and basket values in Singapore’s competitive environment.

Conclusion: In Singapore, Data-Led Entry Is Not Optional

Singapore offers exceptional advantages as a market and regional launchpad. But data consistently shows that success depends on preparation, not proximity. Companies that combine rigorous local research, regulatory readiness, tested channel strategies, and digital-first execution significantly improve their odds of sustainable growth.

For organizations considering Singapore market entry, the question is no longer whether to enter, but how informed that entry will be. A deliberate, data-backed approach is the difference between rapid traction and costly course correction.